Like all annuities, an indexed annuity is a contract with an insurance company that provides an income stream — either immediately or at some point in the future — in exchange for premium payments.

However, indexed annuities also offer potential for gain when the market is riding high, while helping to protect principal during a downturn.

If the market has a negative year, you would receive a specified minimum rate of return (typically 1% to 3%), as long as you hold the annuity until the end of the contractual term. If the market has a positive year, you would receive a higher return based on the performance of a specified index such as the S&P 500.

Calculating Return Rates

The annuity gain in relation to the index is typically calculated in one or more of the following ways.

Participation rate. Determines how much of the index gain will be credited to the annuity. For example, a participation rate of 80% means the annuity would be credited with 80% of the gain experienced by the index.

Spread/margin/asset fee. May be assessed in addition to, or instead of, a participation rate. For example, if the index gained 10% and the spread/margin/asset fee was 2.5%, then the gain in the annuity would be only 7.5%.

Interest-rate cap. The maximum rate of interest the annuity will earn. For example, if the index gained 10% and the cap rate was 6%, the gain in the annuity would be 6%.

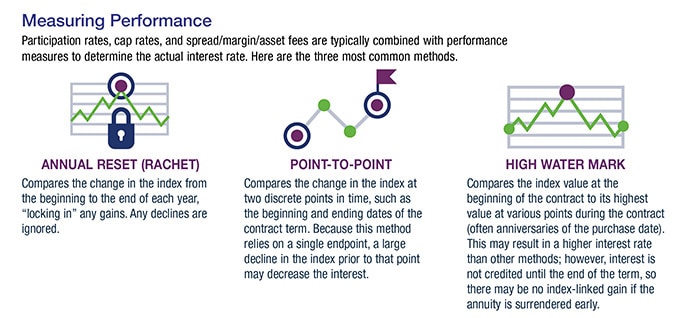

Index performance generally does not include dividends, and the way in which performance is measured may vary depending on the contract (see chart). Participation rates, cap rates, and other fees are set by the insurance company. Some companies may change these provisions annually or at the start of each contract term, which could affect the investment return.

Some Considerations

Most annuities have surrender charges that are assessed if the contract owner surrenders the annuity during the early years of the contract. However, some indexed annuities allow withdrawals of up to 10% per year without surrender charges. Any withdrawals will reduce the principal, and withdrawals before the end of an index period will receive no interest for that period. Early withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty.

Indexed annuities are complex products and are not appropriate for every investor. Like all annuity products, they have rules, restrictions, and expenses. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company. Depending on the guarantees of the issuing company, it may be possible to lose money with this type of investment. Be sure to review the contract carefully before deciding whether to invest.

The S&P 500 index is an unmanaged group of securities that is widely recognized as representative of the U.S. stock market in general. You cannot invest directly in an unmanaged index and do not actually own any shares of an index.